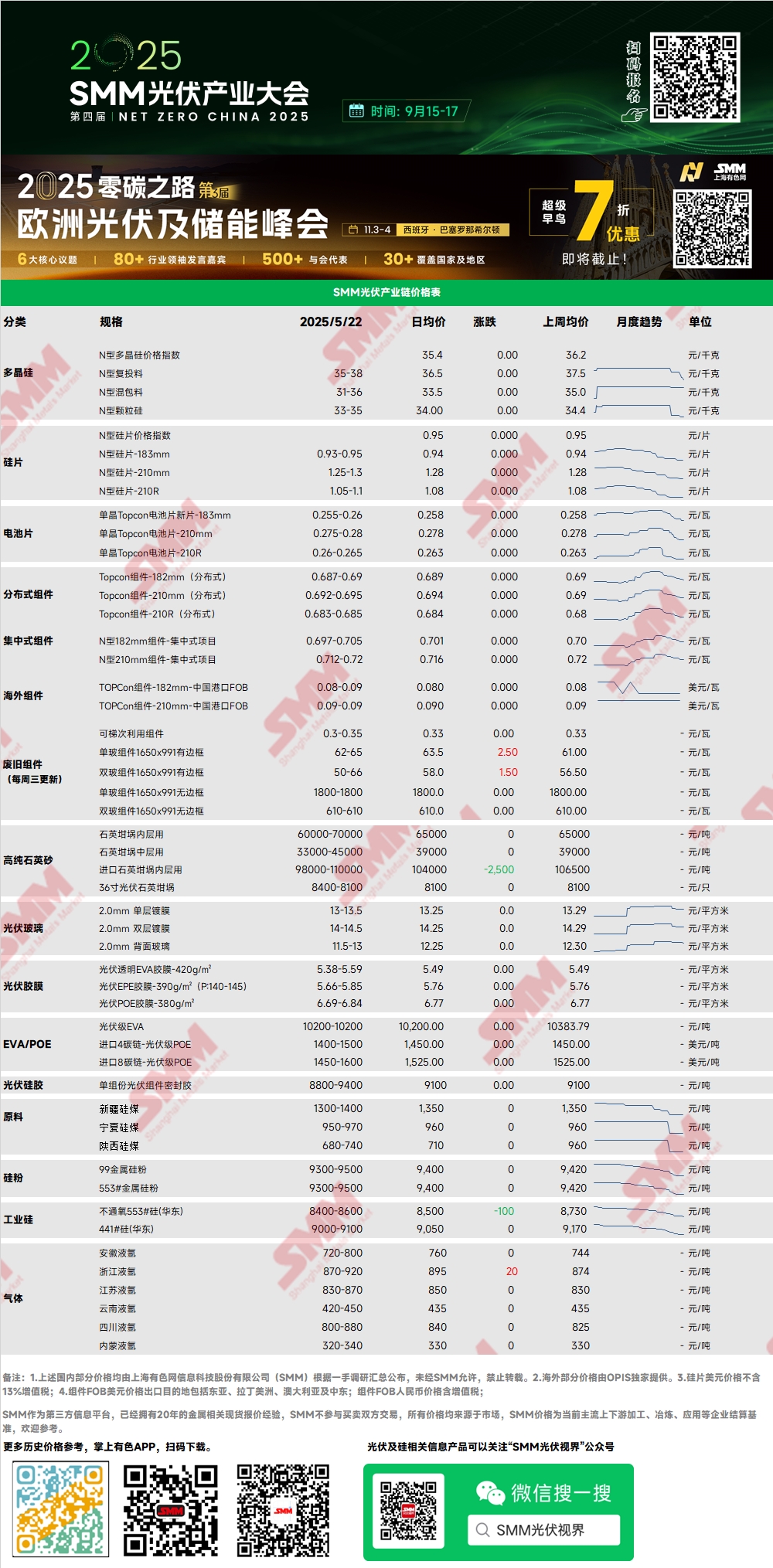

Polysilicon: This week, the price index for N-type polysilicon was 35.4 yuan/kg, with N-type recharging polysilicon priced at 35-38 yuan/kg, and N-type mixed polysilicon priced at 31-36 yuan/kg. Polysilicon prices declined. Market transactions gradually picked up this week, with polysilicon prices ultimately falling in this round of order signing, and the price drop for mixed polysilicon was more pronounced. The average price of some orders containing broken materials fell below 30 yuan/kg. High-quality dense recharging polysilicon remained relatively resilient, with some orders holding firm at 35 yuan/kg amid price negotiations. Additional orders may still be signed. Currently, there are signs of stabilization in the wafer and cell sectors, which may provide some support for polysilicon prices (especially high-quality materials). However, some manufacturers' mixed polysilicon containing cauliflower and coral materials may still have some room for downward adjustment.

Wafer: This week, the price of N-type 183 wafers was 0.93-0.95 yuan/piece, 210R wafers were priced at 1.05-1.1 yuan/piece, and 210 wafers were priced at 1.25-1.3 yuan/piece. The price center of wafers shifted downward, with some top-tier enterprises already offering quotes of 0.93 yuan/piece for 183 wafers. The pressure on other manufacturers continued to increase, suggesting there may still be room for further downward adjustments. However, considering cost factors and limited supply from upstream and downstream, as well as the expected recovery in end-use demand in the later part of Q3, the downward space is anticipated to be very limited.

Cell: For P-type cells, the market quotation for 182P was 0.275-0.295 yuan/W, with prices declining. There were fewer domestic orders, mainly driven by export demand. The PERC210 cell market saw no transaction volume. The overall demand scale for P-type cells contracted. For N-type cells, the quotation for 183N was 0.255-0.26 yuan/W, the mainstream quotation for 210RN was 0.265 yuan/W, with a quotation range of 0.26-0.27 yuan/W, and the quotation for 210N was 0.275-0.28 yuan/W. Compared to last week's prices, cell prices generally continued to decline, but there was a divergence in market trends by size. The price of 183N cells fell further, mainly due to reduced orders and inventory backlogs leading to price cuts and destocking. The price of 210RN cells rebounded, with orders increasing driven by distributed surplus demand, leading to an increase in transaction prices. The price of 210N cells remained relatively stable, but there was downward pressure due to price competition. It is expected that under the trend of large-size wafers, the future demand for 210-series solar cells will be more optimistic, but the anchor point for overall demand still lies in the module sector's assessment of end-use market capacity.

Overall, solar cell plants are gradually cutting production in May to control supply and stabilize prices. It is expected that production schedules in June will further tighten in line with the module sector's plans.

Module: This week, PV module prices stabilized after a period of decline. The mainstream transaction price for N-type 182mm modules in centralized projects was between 0.697-0.705 yuan/W, with the average price remaining flat. The mainstream transaction price for N-type 210mm modules was between 0.712-0.72 yuan/W, with the average price also remaining flat. The price of distributed N-type 182 modules hovered around 0.687-0.69 yuan/W, with the average transaction price becoming more concentrated. The price of distributed N-type 210 modules stood at 0.692-0.695 yuan/W, with the average transaction price also becoming more concentrated. The price of distributed N-type 210R modules was in the range of 0.683-0.685 yuan/W, with the average transaction price showing increased concentration. This week, module transaction prices stabilized temporarily. The volume of orders for distributed modules decreased significantly. Central and state-owned enterprises slowed down the pace of centralized order signing, and weakening demand compelled module manufacturers to cut production again. The expected module production schedule for May was revised downward once more compared to the beginning of the month. There were clear signs of weakening expectations on the domestic demand side. After the announcement of the June bidding notice, domestic terminals will be able to accurately calculate project yields. Blindly reducing prices in the short term may not guarantee smooth shipments.

Terminal: From May 12, 2025, to May 18, 2025, SMM statistics showed that a total of 21 PV module project sections were awarded to multiple enterprises in China during the week, including LONGi Lerri Solar Technology Co., Ltd., China Railway Erju 4th Engineering Co., Ltd., and Guangdong Mingyang Photovoltaic Industry Co., Ltd., among which 9 projects disclosed their installed capacities. The main types of modules procured and awarded this week were N-type and P-type PV modules. The winning bid prices for PV modules were concentrated in the range of 0.65-0.86 yuan/W, with a weekly weighted average price of 0.71 yuan/W, a decrease of 0.05 yuan/W compared to the previous week. The total procurement capacity for awarded modules this week was 29.55 MW, a decrease of 234.22 MW compared to the previous week.

EVA: This week, the price of PV-grade EVA ranged from 10,200 to 10,650 yuan/mt. Prices for foam-grade and cable-grade EVA also declined significantly, with transaction volumes falling short of expectations. The continuous decline in module prices on the demand side drove down film prices. With weak demand, film enterprises slowed down their procurement pace. It is expected that petrochemical enterprises will prioritize profit concessions for shipments in the short term, and EVA prices may continue to decline.

Film: The mainstream price range for EVA film was 13,000-13,200 yuan/mt, while the price range for EPE film was 14,500-15,000 yuan/mt. With the continuous decline in module prices on the demand side and weakening demand, the continuous pullback in the price of PV-grade EVA on the cost side provided cost support for the decline in film prices. It is expected that film prices will remain in the doldrums in the short term.

POE: The domestic delivery-to-factory price of POE remained stable at 12,000-14,000 yuan/mt. Despite maintenance at some petrochemical enterprises, under the dual pressures of weak demand and the gradual release of new capacity, the market price of PV-grade POE is expected to fluctuate downward.

PV glass: This week, some PV glass enterprises lowered the center of their quotations. As of now, the mainstream quotation for 2.0mm single-layer coated PV glass in China was 13.3 yuan/m², with some enterprises offering prices below 13 yuan/m². The mainstream quotation for 3.2mm single-layer coated PV glass was 21.0 yuan/m², and the mainstream quotation for 2.0mm back-sheet glass was 12.0 yuan/m². This week, the center of quoted prices in China's domestic PV glass market has moved downward. As of now, the quoted price for 2.0mm single-layer coated PV glass is 13-13.5 yuan/m². Due to the continuous decline in module demand and the fact that module prices remain low, the peak season for terminal installation rush has passed. There are expectations of a further decline in subsequent module scheduled production. Glass enterprises are facing insufficient subsequent orders, and most have started to offer discounts to take orders this week, leading to an overall decline in market quoted prices. However, module enterprises have still not started large-scale purchases and are mainly inquiring about orders and driving down prices. It is expected that there will still be downside room for subsequent glass transaction prices.

High-purity quartz sand: This week, the quoted prices for some high-purity quartz sand products in China have continued to fall. The current market quoted prices are as follows: 60,000-70,000 yuan/mt for inner-layer sand, 33,000-45,000 yuan/mt for middle-layer sand, and 18,000-24,000 yuan/mt for outer-layer sand, with prices temporarily stable. However, the quoted prices for spot orders from imported sand traders have decreased significantly this week, with the lowest quoted price dropping to 98,000 yuan/mt. Moreover, negotiations for long-term contracts on imported sand have recently entered a stalemate. With the weakening support from wafer production schedules, market transactions have cooled rapidly. It is expected that market prices will start to decline around early June, with the price of imported sand spot orders possibly approaching 90,000 yuan/mt and the price of domestically produced inner-layer sand further declining.

》View the SMM PV Industry Chain Database

![[SMM PV News] Armenia Hits 1.1 GW Solar Capacity,](https://imgqn.smm.cn/usercenter/qQwIB20251217171741.jpg)

![Spot Market and Domestic Inventory Brief Review (February 5, 2026) [SMM Silver Market Weekly Review]](https://imgqn.smm.cn/usercenter/tSwaX20251217171735.jpg)